By Michelle Bakels – Guest Contributor

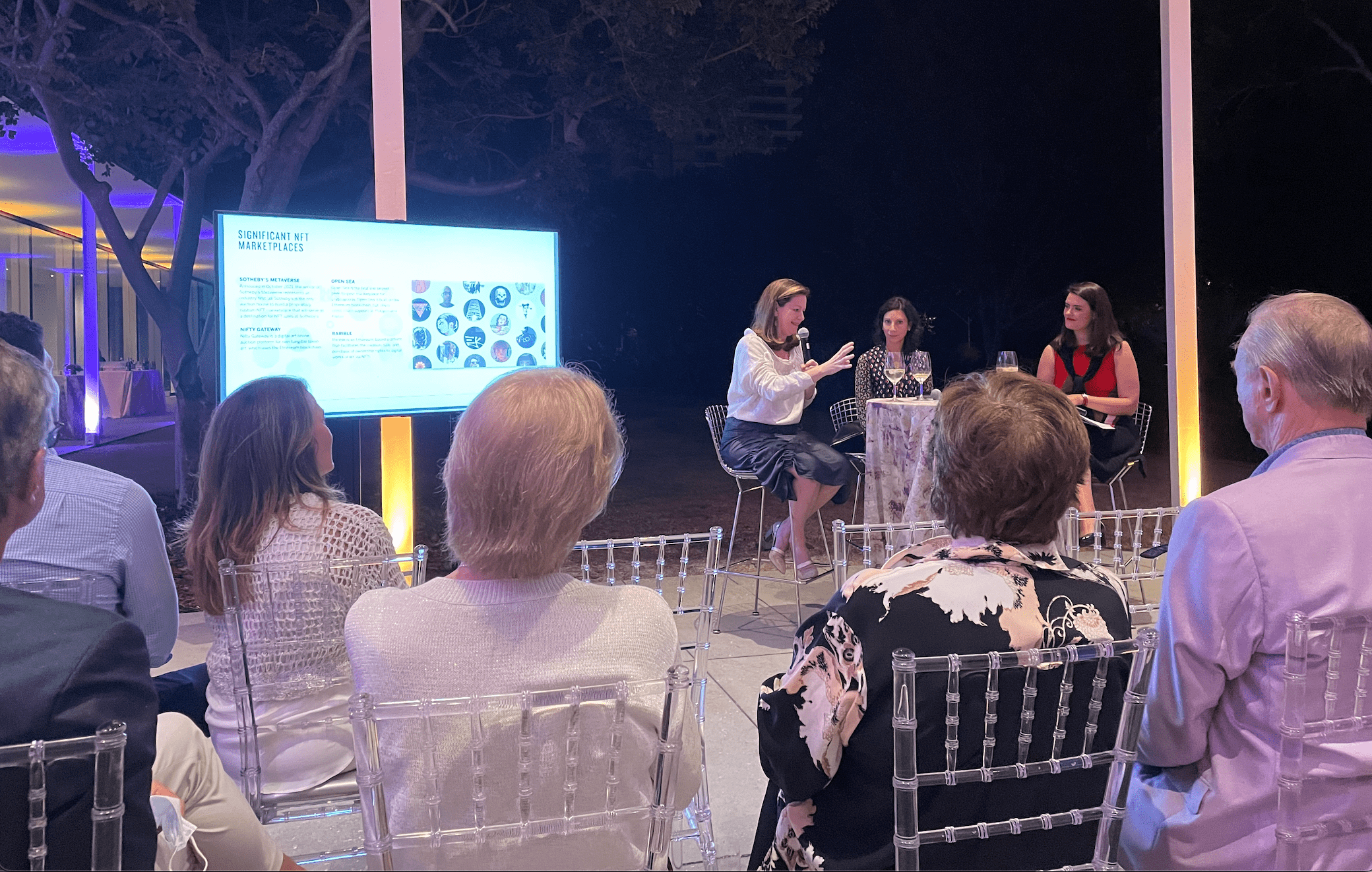

In the sculpture garden of the Norton, passed hors d’oeuvres and sparkling wine preceded a night of lively discussion among art collectors anxious to understand NFTs and their abrupt entrance into the art market.

Monday, November 24th, the Norton Museum of Art in West Palm Beach welcomed Young Friends members for the “Monet to CryptoPunks” panel discussion in partnership with Sotheby’s. Nina Del Rio, Sotheby’s Vice Chairman and Head of Sotheby’s Advisory, Julian Dawes, Sotheby’s Senior Specialist and Global Co-Head of Marquee Sales, and Amy Whitaker, leading blockchain researcher and professor in Visual Arts Administration at NYU Steinhardt, comprised the panel that guided the predominantly more senior audience through an introduction of NFTs, purchasing, and investment.

The presentation began with defining core concepts such as blockchain, NFTs, and smart contracts, before leading into a series of auction sale case studies ranging from Beeple’s “Everydays — The First 5000 Days” to Larva Labs’ “CryptoPunk 7523.” Although it was reiterated numerous times that questions would be reserved for the end, the excitement and curiosity gave way to a flood of questions from the audience that prevented the presentation from coming to its intended conclusion.

The attendees came ready to ask burning questions around this new medium such as: Is Sotheby’s validating a market for NFTs simply by listing them on auction? Who are the collectors of NFTs? Are the current collectors genuinely interested in supporting artists, or is this a means of validating cryptocurrency? How do NFTs differ from other forms of media art such as video? Are buyers purchasing these works in crypto, and if they are, is Sotheby’s converting those payments or holding the crypto?

Most questions throughout the evening could not be answered definitively, however there was meaningful knowledge sharing and important context offered within the beginner-friendly space provided by the Norton Museum. “It was incredible seeing some tenured art collectors have the NFT “aha” moment,” said Brandon Ginsberg, CEO of ApparelMagic, “[The panelists] did a great job describing the potential benefits to museums and curators through new revenue streams made possible with NFTs.”

Looking closer at the sale of Beeple’s “Everydays — The First 5000 Days” at Christies, of the 33 bidders, 91% were new clients with two-thirds being millennials or younger. At the completion of this purchase, Beeple became one of the top three living artists in the world among Jeff Koons and David Hockney. With NFT creators breaking into the ranks of decades-long established canonical artists, and mature collectors seeking to understand more about this medium, it begs revisiting the question of validation. Is Sotheby’s validating the NFT market by placing these works on auction, or is the crypto-collector market validating the relevancy of traditional auctions by purchasing works through their houses?

Regardless of the numerous positions, perspectives, and opinions in the NFT space, these creations are beginning to sell at consistently high rates, making it more difficult to ignore their market impact. For example, the current floor (minimum purchase price) for the mega popular Bored Ape Yacht Club sits at 45.99ETH (ether) which is roughly equivalent to $188,228. As we continue to see million-dollar NFT sales at auction, debates roil among members of both the tech and art industries. Both camps have deep knowledge in their respective fields, however bridging these two communities will be key in reaching a more complete comprehension and potential for the future of NFTs in the art market.

Michelle Bakels is the Program Director at G2i where she creates community-focused solutions for developer health and preventing and recovering from burnout. Michelle holds bachelors degrees in Art History and Computer Science, and has spent the last several years as a software engineer in South Florida.

- An innovation is born: New mom and FIU student pitches her baby bottle monitor on Shark Tank - April 12, 2024

- Miami: the Dubai of the Western Hemisphere - February 20, 2024

- What I learned facilitating an AI hackathon for ACT House in Miami - February 16, 2024