The Miami Movement is powering an explosive year for Miami metro area, show two VC reports

With three months still to go, the Miami metro area has already set a record for venture capital and is on pace for a breakout year. That’s according to a pair of reports out this week.

Powered by Miami’s momentum of the past year, venture capital in South Florida has shown considerable strength year to date. With prominent funders like SoftBank, Founders Fund, Tiger Global and General Catalyst finding deals in the region and hundreds of investors and venture-backed startups relocating from the Valley and New York in the last year, Miami Mayor Francis Suarez’s Capital of Capital is already bearing fruit in venture capital activity.

One of the quarterly VC reports, CB Insights 263-page global State of Venture Q3 2021 report, shows a $1.36 billion Q3 surge across 72 deals, bringing the year-to-date total for the Miami-Fort Lauderdale metro to $2.4 billion. That total already exceeds each of the three preceding years, which together brought an unprecedented 3-year run of $6.5 billion for South Florida companies, according to my reports for eMerge Americas, According to CB Insights, year-to-date Miami now ranks 9th among metro areas for dollars invested.

And the fourth quarter is off to a good start. CB Insight’s total does not include the $500 million raise by Magic Leap announced Monday, or the $10 million Series A for CAST AI announced Tuesday. Nor does it likely include another $42 million in raises announced by Aprende Institute and Ontop, in the past week. As it stands now, VC dollars flowing in are up another 22% in Q4, and given the momentum the Miami metro area has been experiencing, well, there is still a lot of time left in 2021.

Here are the top 5 deals of Q3, according to CB Insights (you can read more about Unybrands here and RECUR here):

According to CB Insights, the venture capital in the US has also blown past 2020’s dollar total, adding up to $210.4 billion year to date across 8,869 deals, compared to $142 billion (9,846 deals) in 2020. Worth noting is that means that the Miami-Fort Lauderdale metro area’s slice was still teeny tiny, just 1.1% of US total.

But here is another interesting observation from the CB Insights’s list of the 10 most-active US-based investors in Q3: At least 7 of them now have some sort of presence in Miami; for some it may be one partner but it’s a start. And we can add at least one more from the global most-active list – SoftBank. We’ve come a long way.

Download the CB Insights State of Venture Q3 report here.

What does a second report, Venture Monitor, say? (story updated 10/14/21)

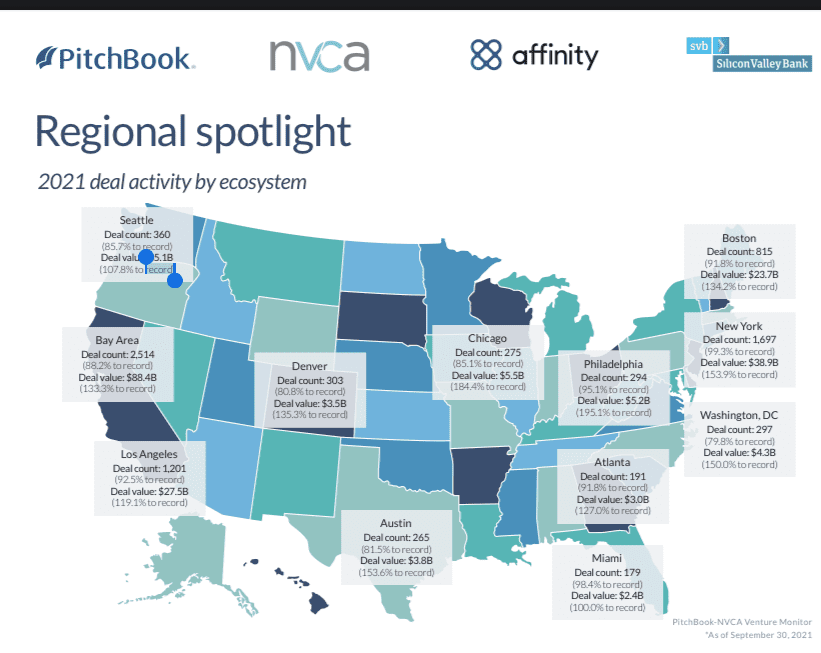

On Thursday, the National Venture Capital Association and Pitchbook released their Q3 report, the Venture Monitor, and although the reporting methodologies were different from CB Insights, remarkably the big number for South Florida came out about the same.

According to Pitchbook, companies in the Miami-Fort Lauderdale metro area raised $2.4 billion in the first three quarters, reaching an all-time high with a quarter still to go. The 179 deals year to date for South Florida is already knocking on the door for a record high, and well ahead of the first three quarters of any other year, according to the report.

The Miami-Fort Lauderdale metro area ranked 12th in the US by number of deals, according to Pitchbook.

Miami’s fund-raising success is pulling up the state. In the first three quarters, companies in Florida attracted $3.2 billion – already way into record territory for the state, across 248 deals, according to Pitchbook’s data. South Florida companies reaped 75% of the investment dollars in the state in the first three quarters, according to the Venture Monitor.

According to Pitchbook, here are the South Florida companies that raised the most funding in Q3. The list differs quite a bit from the top deals CB Insights reported earlier this week because Pitchbook doesn’t include private equity rounds The companies were:

- Nuula, fintech, later stage, Coral Springs & Toronto. $120 million

- Marco, fintech, seed, Miami: $82 million

- Expansion Therapeutics, Series B, biotech, Jupiter, $80 million

- Misfits Gaming, gaming media, later stage, Boca Raton: $35 million

- Openstore, Shopify rollup, Series A, Miami: $30 million

Pitchbook’s data only showed two exits in Q3 for the Miami-Fort Lauderdale metro area: HCW Biologics for $229 milion and East Imperial for $42 million.

Nationally, the Venture Monitor has been tracking investment into women-led companies. Their data shows that the needle has moved very much. In 2021 so far, teams with at least one female founder have attracted 17.2% of all deal value, but all-female teams actually fell from 2.2% in 2020 to 2% in 2021. As for share of the deal count, all female teams attracted 6.5%, about the same as 2020, and companies with at least one female co-founder attracted 25.3%.

Here’s another interesting stat from the report: Deal size and valuation seriously lag as well. For deal size, the median raise for all-male teams was $3.5 million, while for mixed teams it was $3 million but for all-female teams the media raise was just $1.6 million. For valuations, the trend is similar: Media valuations among all-male teams was 75% higher than all-female teams, and mixed teams fell in the middle. I plan to look at this trend locally in my full-year report.

As for dominant sectors, at midyear 2021, I reported that fintech took over as the most active sector in South Florida, a perch long held by healthtech/biotech, and that trend looks poised to continue, given the global, national and local activity in the red-hot financial technology sector. How hot? Nationally, dollars invested in fintech so far this year are double what they were in all of 2020, according the the Venture Monitor, a trend also noted in CB Insights’ report. Deal counts are up, too. In looking at the deals list for our region, I see a strong showing by fintech startups continuing into Q3 and a few are among the top deals of the year. I will also have more about this is my yearly report.

Download the extensive Venture Monitor report here.

Note: VC data lags (which means constant revisions in these reports) and each data firm tracks VC a little differently. For instance CB Insights does not include angel rounds so its deal totals are lower than Pitchbook’s and Pitchbook does not include all private equity rounds so its dollar total is typically lower (though they do not differ much this year). For my South Florida mid-year and full-year reports for eMerge Americas, I aim to include both private equity and angel rounds for a comprehensive view of activity in the South Florida region.

Download eMerge Insights report for 1H 2021 here and stay tuned for eMerge America’s 2021 full report with the lowdown on our breakout year.

Follow @ndahlberg on Twitter and email her at [email protected]

READ MORE RECENT VENTURE NEWS ON REFRESH MIAMI:

- Magic Leap raises $500M on $2B valuation; set to roll out Magic Leap 2 next year

- To bring cloud costs back down to earth, Miami startup CAST AI raises $10 million Series A round

- Amid rapid growth, Aprende Institute raises $22M to dominate skills training market in Spanish-speaking world

- Global hiring and payments platform Ontop raises $20M from Tiger Global, SoftBank

- Global venture firm G Squared announces new $1.2B fund, expansion to Miami

- myBasePay secures funding to enable distributed workforces in South Florida and beyond

- Human ingenuity, inspiration, a call to action: Miami Tech Talent Coalition takes the stage at eMerge Americas - April 24, 2024

- Miami Tech Month, where developers get their own conference, VCs take the stage, and anything is POSSIBLE - April 23, 2024

- Full circle moment for Johanna Mikkola, the new CEO for Tech Equity Miami - April 22, 2024